I leader della finanza internazionale simulano un crollo finanziario globale. Dobbiamo preoccuparci?

Traduzione dell’articolo di Michael Nevradakis, Ph.D e Giornalista indipendente di Atene, apparso in https://childrenshealthdefense.org/defender/leaders-war-game-exercise-global-financial-collapse/

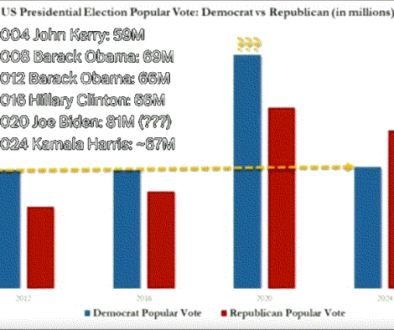

Funzionari di alto livello e organizzazioni bancarie internazionali si sono riuniti nel dicembre 2022 per un “gioco di guerra” globale che ha simulato il collasso del sistema finanziario globale. La cosa ha ricordato “Event 201”, l’esercizio di simulazione di una pandemia da Coronavirus che ? stato fatalmente poco dopo seguito dalla entrata globale in scena del COVID-19.

La simulazione denominata “Forza collettiva” si ? tenuta dal 9 dicembre 2021 presso il Ministero delle Finanze israeliano a Gerusalemme ed ? durata 10 giorni.E’ stata trasferita a Gerusalemme dall’Expo mondiale di Dubai per le preoccupazioni sulla variante Omicron.

Israele ha guidato un contingente di 10 paesi che comprendeva anche funzionari del Tesoro di Stati Uniti, Austria, Germania, Italia, Paesi Bassi, Svizzera, Thailandia ed Emirati Arabi Uniti.

Hanno partecipato anche rappresentanti di organizzazioni sovranazionali, come il Fondo Monetario Internazionale (FMI), la Banca Mondiale e la Banca dei Regolamenti Internazionali (BIS).

Descritto come un “gioco di guerra” simulato, l’esercizio ha cercato di modellare la risposta a vari ipotetici cyberattacchi di larga scala sul sistema finanziario globale, comprendente anche la fuga di dati finanziari sensibili nel “Dark Web”, hacker che prendono di mira il sistema globale di cambio, e la successiva corsa alle banche ed caos nel mercato finanziario alimentato da “fake news”.

Il tema principale di “Forza collettiva” non ? sembrata tanto la simulazione di tali attacchi informatici, ma, come il nome dell’iniziativa implica, il rafforzamento della cooperazione globale nel settore finanziario riguardo alla sicurezza informatica.

Come riportato da Reuters, i partecipanti alla simulazione hanno discusso le risposte multilaterali a un’ipotetica crisi finanziaria globale.

Le soluzioni politiche proposte includevano dei periodi di grazia per il rimborso del debito, accordi SWAP/REPO, sospensioni bancarie coordinate e cancellazione coordinato dalle principali valute.

L’idea di una cancellazione simulato dalle principali valute ha suscitato qualche perplessit? a causa della sua tempistica perch? lo stesso giorno in cui i partecipanti si sono riuniti per lanciare “Collective Strength” sono circolate notizie che l’amministrazione Biden stava prendendo in considerazione la rimozione della Russia dal sistema globale di messaggi elettronici di pagamento noto come SWIFT, abbreviazione di Society for Worldwide Interbank Financial Telecommunication. Questa misura farebbe parte di un pacchetto di sanzioni economiche che gli Stati Uniti applicherebbero contro la Russia qualora attaccasse l’Ucraina.

Pu? far sollevare ancora di pi? le sopracciglia la lista dei partecipanti alla simulazione “Forza collettiva”, hanno partecipat il FMI e la Banca Mondiale, e indirettamente, il World Economic Forum (WEF).

Ricordiamo che a gestire la simulazione “Evento 201” nell’ottobre 2019 ? stato proprio il WEF, insieme alla Bill & Melinda Gates Foundation e alla Johns Hopkins Bloomberg School of Public Health.

Come precedentemente riportato da The Defender, il WEF ha anche sostenuto lo sviluppo di strumenti finanziari, come carte di credito e di debito, che traccerebbero “quote di carbonio personali” su base individuale.

Un report pubblicato nel novembre 2020 dalla Carnegie Endowment for International Peace, in collaborazione con il WEF, ha fornito una panoramica del tipo di scenario che ? stato simulato come parte di “Collective Strength”.

Gli autori del rapporto, Tim Maurer e Arthur Nelson, hanno descritto un mondo il cui sistema finanziario sta subendo “una trasformazione digitale senza precedenti ? accelerata dalla pandemia del coronavirus” per cui “la sicurezza informatica ? pi? importante che mai”.

Descrivendo la protezione del sistema finanziario globale come una “sfida organizzativa”, il rapporto ha sottolineato che non c’? un chiaro attore globale incaricato di proteggere il sistema finanziario globale o la sua infrastruttura digitale, e si ? spinto fino a descrivere una “disconnessione tra la finanza, la sicurezza nazionale e le comunit? diplomatiche”.

Le soluzioni identificate da Maurer e Nelson includono:

- La necessit? di “maggiore chiarezza” per quanto riguarda i ruoli e le responsabilit?

- Rafforzare la cooperazione internazionale

- Ridurre la frammentazione e aumentare l'”internazionalizzazione” tra istituzioni finanziarie “siloed”.

- Sviluppare un modello che possa poi essere utilizzato in non meglio precisati “altri” settori.

Ma non hanno indicato quali “altri” settori.

Questa serie di raccomandazioni ? stata classificata dagli autori nel loro rapporto sotto “Trasformazione digitale: Salvaguardare l’inclusione finanziaria”.

Una di queste raccomandazioni recita come segue: “Il G20 dovrebbe evidenziare che la sicurezza informatica deve essere progettata nelle tecnologie utilizzate per promuovere l’inclusione finanziaria fin dall’inizio, piuttosto che essere inclusa come un ripensamento”.

La tecnologia che ? “usata per avanzare l’inclusione finanziaria dall’inizio” sembrerebbe includere “passaporti sanitari” digitali e “portafogli digitali” di accompagnamento.

Sembra anche essere allineato con gli obiettivi di sviluppo sostenibile delle Nazioni Unite – in particolare, l’obiettivo 16.9, che chiede la fornitura di un’identit? legale digitale per tutti, compresi i neonati, entro il 2030.

L’obiettivo 16.9 porta anche alla mente l’insistenza dell’Unione europea sul fatto che il suo passaporto per i vaccini, il cosiddetto “Green Pass”, che ? usato in numerosi paesi europei per impedire ai non vaccinati e a quelli con immunit? naturale di entrare in tutti i tipi di spazi pubblici e privati, protegge la privacy degli individui.

In un ulteriore collegamento tra due questioni distinte – la sicurezza del sistema finanziario globale e la salute pubblica – la GAVI Vaccine Alliance ha chiesto “innovazioni che sfruttino le nuove tecnologie per modernizzare il processo di identificazione e registrazione dei bambini che hanno pi? bisogno di vaccini salvavita”.

Tuttavia, l’uso di queste tecnologie non si fermerebbe alla registrazione delle vaccinazioni infantili. GAVI ha descritto i potenziali usi di queste “nuove tecnologie” come comprendenti “l’accesso ad altri servizi”, compresi i “servizi finanziari” definiti in modo ampio.

Gli autori del riassunto esecutivo del Carnegie Endowment hanno rispecchiato le loro proposte in un articolo della primavera 2021 che appare sul sito del FMI, anche se le questioni di “inclusione finanziaria” sono lasciate fuori.

Mentre i due autori del rapporto Carnegie, e i partecipanti all’iniziativa “Collective Strength”, sottolineano la necessit? che il sistema finanziario e i suoi dati digitali siano meglio protetti, rimane poco chiaro come una continua trasformazione verso un ambiente completamente digitale e basato sul cloud possa davvero essere considerata “sicura”.

Si consideri, per esempio, la seguente osservazione di Micha Weis, cyber manager finanziario presso il ministero delle finanze israeliano, in riferimento a “Collective Strength”: “[a]ttackers sono 10 passi avanti al difensore”.

Tali parole non offrono molto conforto a coloro che sono gi? diffidenti verso il “FinTech”, o la crescente vicinanza tra “Big Tech” e “Big Finance”.

Allo stesso modo, l’ennesima “simulazione” di una catastrofe globale su larga scala e distruttiva, per alcuni, riporter? alla memoria l'”Evento 201″ e ci? che ne ? seguito – tristemente descritto il 20 marzo 2020, dall’allora Segretario di Stato americano Mike Pompeo come un “esercizio in diretta”.

Nota del Traduttore (Loris Palmerini): tutto lo scenario simulato realizza in realt? ci? che ? stato chiaramente indicato come obbiettivo da realizzare dagli stessi partecipanti che in buona parte sono nell’organizzaizone www.id2020.org, ossia lo scenario ? la realizzazione dei loro scopi dichiarati e da me evidenziati nella conferenza del 24 Aprile 2020 intitolata “Covid-19: pandemia o attentato alla libert?”