The Italian State to Pay Money 6% instead of the 0,5% : proof of seigniorage

Caution: You may not reproduce this text, allowed only links to the page. Anyone who uses this discovery of mine without mentioning me is a dishonest individual who tries to extract consent. Also the text has been updated in this page . The following text is the original of 2012, date of my discovery.

Caution: You may not reproduce this text, allowed only links to the page. Anyone who uses this discovery of mine without mentioning me is a dishonest individual who tries to extract consent. Also the text has been updated in this page . The following text is the original of 2012, date of my discovery.

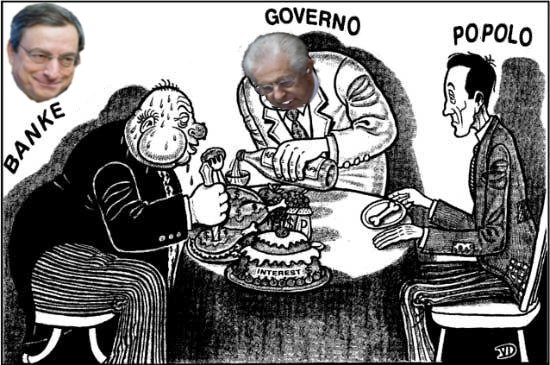

When the Italian State, Greece, Spain and many others were going to ask for money to “market”, that is, they issue government bonds such as BTPs or CTZs , they do on the financial market, and pay interest determined by various factors. Currently the state pays the 2,5% Al 5% interest. For Italy it is a question of renewing hundreds of billions every year, spending so many billions of euros interest-only. When the market considers unreliable or unstable political situation, the state pays more interest for “renew” its public debt. All TV days haunts us with the “SPREAD BTP-BUND” which is the difference between the interest rate paid by Italy and that paid by Germany, Today around 2,5 (set. 2013), that is expressed in “basis points”: 230 It means 2,3%.

To finance the states are private banks, but where to take this money private banks? They take the loan money by the ECB (the one that prints the Euro and which is actually also a private bank, albeit controlled by the banks “national”, Why “national” it does not mean “of the state”) . Private banks also pay them an interest, but the 05% (annual) from May 2013 (later also nothing at all), I give 10 years less than 1%. Why this difference? Why states do not access the same private banks loan facility? Because the Italian state doesn't borrow money directly from the ECB instead of from the market where it pays much more interest? They say politicians, the government, the IMF, the ECB and the European Commission that a State of the Union cannot receive loans from the ECB, but fail to tell “directly”. And so the Salva States Fund was created, which strangely enough also participate in the International Monetary Fund (which is not even a European bank) and other international banks, to fulfill this purpose. This Fund has lent or will lend money to the various states of the union receiving enormous interest, money stolen from the peoples of the European Union. All of this actually has the only result of further indebting the European states, that the peoples, ie you, instead of helping them out of the crisis because the fund asks for very high interest. Participation in this fund itself is highly criticized because it costs a lot even when no money is borrowed. Yet it is not at all necessary for states to be subject to such rates nor are they obliged to finance themselves on the financial market. In fact the Treaty of Lisbon, in effect since 2009, in particular the Treaty on the Functioning of the EU, clearly provides that THE STATE MAY BORROW MONEY FROM THE ECB PROVIDED IT DOES IT THROUGH A OWNER BANK’ of the state. The Lisbon Treaty states that “in the context of the supply of liquidity by central banks“, ” “publicly owned credit institutions” “They should receive from national central banks and the European Central Bank as private credit institutions.” Article 123 (ex Article 101 TEC) 1. They prohibited the granting of overdraft facilities or any other type of credit facility,by the European Central Bank or with the central banks of the Member States (hereinafter referred to as the "national central banks"), in institutions, organs or bodies of the Union, central governments, regional bodies, local or other public authorities, to other public law, or public undertakings of Member States, as well as the direct purchase of securities from them debt by the European Central Bank or national central banks. 2. The provisions of paragraph 1 do not apply to publicly owned credit institutions which, in the context of the supply of liquidity by central banks, They should receive from national central banks and the European Central Bank as private credit institutions.” If, therefore, it is true that the Italian State cannot take money from the ECB soon directly, it is possible and foreseen that the state can access the loan from the ECB through a state bank , for example the “Cassa Depositi e Prestiti” . It would be sufficient to place state-owned assets as collateral for the state bank . In the case of Italy, the loan received from the ECB with state-owned companies could be guaranteed, with historic buildings, with domain property, not to say companies with public participation as Finemeccanica that are the next candidates to be sold off the market because of public debt. They would not be sold, Simply put as guarantee (even if there is a need to clean them of parasitism). This makes clear that tens of billions of euros each year are burned to refinance debt (to take money loan ) through the market to 3-6% rather than, as it would be easy to do, drawing on ECB loans to 0,5% ECB, simply using a bank status. The savings would be sufficient to solve ALL THE ECONOMIC PROBLEMS IN ITALY, to prevent the closure of companies, not to remove the sense of life for entrepreneurs who then end up committing suicide . The usury loan is an incitement to suicide of businesses that are being loan sharked. The Italian State and the Government, Monti before and now Letta, on the one hand refinance banks such as Monte Paschi di Siena and others came close to collapse, and then accessing these ECB loans with the guarantees of the Italian State. It happens that the week after ECB lending private banks “pay” the state money at an interest rate 12 times higher. In practice, the non-use of this statutory mechanism of the Lisbon Treaty, and continuous thrust of policy towards Fondo Salva Stati is evidence of a USURER mechanism in action, hidden banking powers that have taken over the United Europe. This system is also a method of driving the various countries into PILOT BANKRUPTCY, including Greece, Spain, Italy. That exposed the plot of “seigniorage” which for many years is spoken . So this is a stroke of state bank, of an attack on the sovereignty of states and peoples We must oppose it peacefully but resolutely, also with international criminal complaints and to this scam. But it must be remembered that we are at war with a hidden banking mafia that is devastating the state and the economy, and perhaps they are actually the result of the attempt to conceal the banking scams that the parties that have emptied the many banks of Italy have operated. So it must be the people not parties to demand the change. Today it is possible. Fill out the form below and send this page to friends.

Antonio Patania

10 April 2015 @ 05:55

many associations are denouncing and promoting causes of unconstitutionality of the laws of ratification of the European treaties. It is not enough if the people do not become aware of this serious situation. European Union

Ermanno De Vivo

30 May 2012 @ 10:30

A nation of sheep deserve a government of wolves…this is the pitiful reality …