Everything collapses but something is born

Here we are, the economic collapse that I had expected from at least 3 years is coming true (if you want to see what I said click here )

Ma se credete di aver già visto il peggio vi sbagliate di molto. Il rallentamento globale dell’economia reale che viviamo sulla pelle è il risultato solamente della prima ondata d’urto che si è scatenata nell’agosto del 2007 .

The waves of November remain to be disposed of 2007, the money given by the ECB December 2007 , and all the jolts of the 2008. (Update, and the financial scandals of 2009 and the stock market crash of 2010.

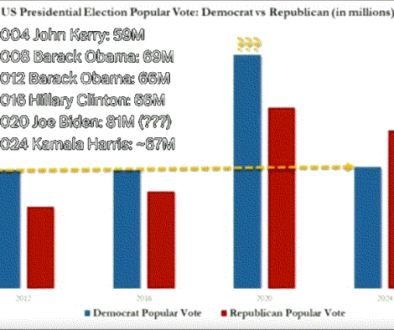

And then end up with the great massacre, cioé quando pagheremo i 1500 billions of dollars that were burned only yesterday 15 September 2008, At least 4 capital times burned in 2007.

Tutto continuerà fino a quando non si accetterà che il dollaro è carta straccia (per altro anche la BCE stampa euro senza relazioni con l’economia).

I affirm that it is the central banks themselves that produce the conomic catastrophe, and I also think they do it specifically to make the world a slave to the seigniorage system. (Update 2010 – una conferma di questo è il fatto che dietro il cosidetto “default” della Grecia si è invece nascosta una operazione di creazione di un “public debt” dell’Unione Europea verso la Banca Centrale Europea, signoraggio su tutta l’Unione).

In italia è già RECESSIONE e l’inflazione promette di arrivare al 12% (TWELVE) by next spring (I say so, we'll see how wrong I am – forecast of 2009, confirmed incorrect but many financial companies implement the 10 percent of debt interest)

The Veneto region and its primary tourism industry also began to sink with Italian bankruptcy. (c’è un interessante article by Benettazzo ) – Update 2010 Veneto +66% of failures.

Infatti lo Stato continua ad incassare sempre di più, to give fewer and fewer services, and equally fails to curb public debt: E’ TECHNICAL BANKRUPTCY (update June 2010 – the public debt will eat up all the taxes – la manovra dimezzerà i servizi pubblici).

Waiting for the announcement (che nessuno farà in puro stile mafioso), while everything collapses, something is born, è il Forum dei Veneti, a new subject able to replace the false managers of the interests of the Venetians (Update 2010- il Forum è affondato per il tentato colpo di mano di vecchie cariatidi politiche ).

E’ the first time that happens in Venetian history (in fact, even the Northern League was born from the money of the Liga Veneta) (Update 2010 – for this reason, PNE also caused the Forum dei Veneti to sink)

E sopratutto per la prima volta si parte dalla consapevolezza che la sovranità del Popolo Veneto è un diritto legale innegabile. Ecco l’articolo su questo (Update 2010 – la consapevolezza c’è ma i politicanti preferiscono parlare di quello che il regime gli lascia dire)

Oliviero

5 October 2008 @ 10:02

thanks Loris,

but what do you mean the dollar is settling ? Concordo che a medio lungo periodo varrà molto meno, , but now because it gets stronger ? Who or what forces the dollar to be strengthened, and with what means ?

Ho sentito parlare dell’Amero che diventerà il sostituo del dollaro; you don't think it would be necessary now ?

garzie

Sincerely

Oliviero

loris

5 October 2008 @ 00:30

Oliviero,

thanks for the question. in my opinion, the dollar is settling, but it is destined to weaken,and a lot. Indeed, the more the central bank prints money not corresponding to real production, the more the currency devalues. Io credo che nell’arco di 1 anno il dollaro finirà a 2 dollars to euro. Not only will the massive placing of dollars printed as postcards contribute to this (nell’ultimo hanno sono oltre 1500 billions of dollars fed into the circuit). The Chinese and Indians will also contribute to this result, which are full of dollars, and they find themselves with less and less value in their hands. So they will start to get rid of it as soon as possible, maybe buying oil, che è quotato in dollari e di fatto è l’unica cosa che gli conferisce valore.

Però succederà che quando i cinesi cominceranno a sbarazzarsi dei dollari, aumenterà la disponibilità nel mercato, creating inflation or rather depreciation. And so the Arabs will raise the price of oil, forcing the Fed to print faster.

E’ un grande monte di carta straccia che ci innonederà insomma. Naturalmente anche l’Euro avrò dinamiche simili, because even the ECB has printed a tremendous wave of Euros, anche essi stampati senza controllo e senza responsabilità penale. and so, come già si annuncia, ci sarà una impennata tremenda di inflazione, hence a devaluation , in pratica una perdita di potere d’acquisto da parte dei lavoratori.

What I would do, being able , would be to borrow me with a nice mortgage, but only at a fixed rate, and knowing that he can cope with the installments, therefore very low. Questo farà sì che il debito verrà mangiato in parte dall’ondata inflazionistica, così come è già successo a metà anni ’70: the then 30-year-olds saw themselves doing the house for free, tanto più che l’economia andava bene.

But as I said, nor the Dollar , nè l’Euro sono valute dal futuro stabile, aim at something less risky like the Australian dollar, and also the Ruble.

Of course a nice mixed portfolio including currencies from China, Brazil, russia, USA, Europe and Switzerland, it guarantees you from every event and from the simple disappearance of the capital.

Ma non prendere le mie parole come d’oro.

Oliviero

4 October 2008 @ 16:32

object : Dollar

Dear Loris, ,

I read you from today 4/10/2008,

causes the financial crisis , I did a full immersion in various sites ,and I ask you: how come that, despite some economists ,say that the dollar has to go down ( ed anch’io lo auspico), you are, to date , strengthening? and a 1.375.

I made several hypotheses, but I would appreciate your opinion.

Thanks bye

Oliviero

Valerio

23 September 2008 @ 11:35

The debt system, that the moneylenders have advertised well, has these prerogatives:

– Get people to buy and consume before they have the resources

materials to buy;

– Invite people to spend all they have, because so much can be done

also pay later;

– Wild INFLATION, perchè più il tempo passa più l’entità della rata

it becomes sustainable;

– Against ants that put money aside, with

argomentazioni cretine e con l’esortazione a dare priorità a questioni di

image and not of substance. moreover, the clever ants have been

trasformate dalla società in deficienti autolesionisti, because it has no

sense to put money aside… “buy as long as they are still worth something”.

The debt system, for which you print money of value equal to paper,

however, it also provides that, parallelamente all’immotivato aumento dei prezzi ci sia

A (no longer unmotivated, because due to an abuse) increase in wages o

salaries or wages.

This has not happened in Italy. why? It means that someone has it

earned big. That continued to report for months in the newspapers

The crisis, and many smartons left and right have solved it

brilliantly printing paper.

In the United States the crisis was provoked by the culture of the mortgage and the

financial loan.

E’ a psychological issue. Less had to be wasted in the past,

get into debt only when strictly necessary or in anticipation of having a

grosso ritorno dall’investimento.

In Veneto we had the culture of ants that had allowed us to

enrich, we had a propensity to save which was our trump card

sleeve: l’abbiamo gettata al vento miseramente. In the name of what? Indebitiamoci

to go on vacation or for the car to show off with friends.

The new generations were brought up with the spritz culture and in

they don't even know they're in the world. They will not be psychologically in

grado di gestire l’enormità di debiti che i loro genitori, even more balls

(sorry for the term), they buckled them. They will not be able to handle them

difficoltà perchè sono stati abituati a non averne, since you could have had so much

now and pay tomorrow.

I never hear people say on TV: “just make debts”. The problem to be solved is

one.

DEBT CULTURE

Andrea

17 September 2008 @ 19:56

would be appropriate, Dear Palmerini, che tu cominciassi a studiare le ultime novità in fatto di signoraggio bancario, offered by the legendary Lino Rossi, whose articles you can find them on soldionline and on Comedonchisciotte, before telling bales to the P……

hello ciaoooo